Bill.com SMBs Divvy Barrononline is a comprehensive suite of business payment services that are specifically designed to help small and medium-sized businesses manage their finances more effectively. It includes a range of services, such as bill pay, electronic invoicing, business accounts payable automation, and more.

What is Bill.com?

Bill.com is an innovative business payment platform that offers a comprehensive suite of payment and cash management solutions for small and medium-sized businesses (SMBs). It offers easy-to-use tools and services to help businesses streamline their payment processes and manage their finances smarter. With Bill.com, businesses can accept payments faster, pay bills quickly, and access their cash more efficiently. It also enables businesses to automate their accounts payable and receivable processes, making them more efficient and cost-effective. In addition, Bill.com also integrates with popular accounting software like Divvy, Barrononline, and QuickBooks to make it easier for businesses to manage their finances. By providing a secure, cloud-based platform, Bill.com helps SMBs achieve greater financial visibility and control.

What are the Benefits for SMBs?

Small and medium businesses (SMBs) are increasingly turning to innovative services such as Bill.com, Divvy and Barrononline to manage their finances. All three of these companies offer different, yet complementary services to help SMBs streamline their financial operations, making it easier for them to manage their day-to-day finances. Bill.com provides a cloud-based accounts payable and receivable solution that allows SMBs to pay and receive payments electronically, eliminating the need for manual processes.

This helps to reduce costs, save time and resources, and simplify back-office operations. Divvy is an automated expense management platform that helps SMBs easily track and manage their spending. It has powerful budgeting and analytics capabilities, allowing SMBs to make better decisions when it comes to their finances. Finally, Barrononline is a financial technology platform that provides SMBs with access to financial institutions such as banks and credit unions. This allows SMBs to easily search for the best rates and terms for loans, credit cards, and other financial products.

What is Divvy?

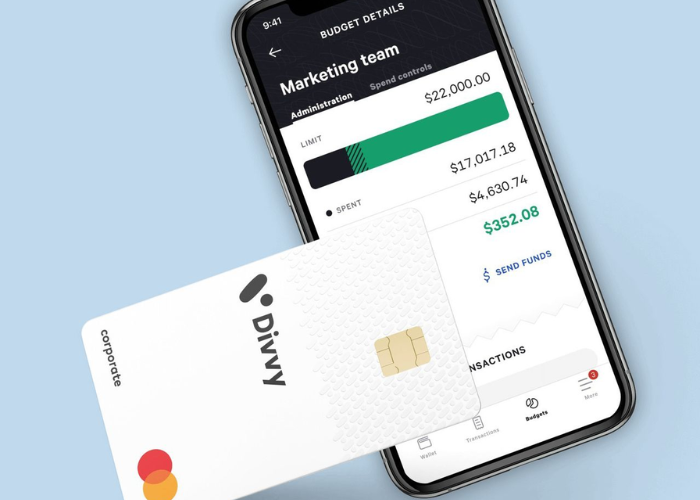

Divvy is an online business finance platform offered by Bill.com and Barrononline that helps small businesses streamline their finances. It simplifies how businesses manage their expenses, track budgets, and monitor cash flow. With Divvy, businesses can easily manage their expenses, track budgets, and monitor cash flow in one place. The platform also provides insights on where to save money, track spending, and quickly pay bills.

Companies can use Divvy to automate their financial processes, such as payroll, invoicing, and payments. Divvy also offers flexible payment terms, allowing businesses to customize payment terms to their own needs. Businesses can also take advantage of spending insights, analytics, and reporting capabilities to gain a better understanding of their financial health. With Divvy, businesses can save time and money, improve cash flow, and gain valuable insights into their financial performance.

What is Barrononline?

Barrononline is a revolutionary digital payment system created by Bill.com and SMBs Divvy. It offers users the ability to make and receive payments from a single interface, allowing businesses to streamline their accounts payable process and increase their cash flow. Barrononline makes it easy to set up and manage invoices, recurring payments, and even payment reminders.

It also offers a variety of features such as secure encryption of sensitive data, real-time reporting, and the ability to track payments in multiple currencies. With Barrononline, businesses can save time and money by reducing the need for manual data entry, reducing manual reconciliation, and avoiding costly late payments. Barrononline also provides users with access to a variety of other services such as automated reconciliation, fraud protection, and integration with QuickBooks and other accounting software.

Comparison between Bill.com, Divvy and Barrononline

When it comes to managing finances for small businesses, there is no shortage of options. There are three popular contenders, Bill.com, Divvy and Barrononline, each of which offers its own unique set of features and advantages. When comparing Bill.com, Divvy and Barrononline, Bill.com stands out for its extensive suite of features, which include automated accounts payable, integrated banking, and secure multi-user access. It also offers the ability to customize settings and automate recurring payments, which makes it a great choice for businesses that need to manage a large number of payments each month.

Divvy, meanwhile, is a more streamlined solution, offering a streamlined and intuitive experience, as well as the ability to set up and manage spending and budgeting in a simple, efficient manner. Barrononline, on the other hand, is a comprehensive accounting and financial management solution, providing real-time insights into financial performance and risk management. When it comes to deciding which of these solutions is best for a business, it depends on each business’s individual needs. For businesses that require comprehensive financial management, Barrononline is likely the best option. For those that need a more streamlined approach to managing payments, Divvy is likely the best choice. And for those that need to manage a large number of payments and automate recurring payments, Bill.com is likely the best choice. Ultimately, it’s important for businesses to carefully consider their needs and choose the solution that best meets their requirements.

Conclusion

There are all powerful tools that can help small businesses streamline their financial operations. Each platform offers its own unique features, allowing businesses to choose the best option for their needs. Bill.com offers a comprehensive suite of services including invoice management, accounts payable/receivable tracking, and automated payments. Smbs is designed to help companies manage their payroll, expenses, and accounts receivable. Divvy is a cloud-based platform that provides businesses with the ability to manage their finances, track employee expenses, and automate payments. Finally, Barrononline provides a comprehensive suite of accounting services, including bookkeeping, tax preparation, and payroll. All of these platforms are great options for businesses looking to simplify their financial operations and improve their bottom line.